NEW YORK – Homebuyers flooded the housing market in the first quarter of the year as they tried mightily to beat the expected mortgage rate hikes – resulting in one of the most competitive quarters since the onset of the pandemic. But there are signs that point to more favorable negotiating conditions for homebuyers in the months ahead, experts say.

Home prices rose by 21% in March from a year ago, the strongest March year-over-year increase on record, according to the S&P CoreLogic Case-Shiller Home Price Index, which developed the series almost three decades ago.

About 7 in 10 homes sold for more than the asking price.

“Homebuyer frenzy reached another new high as eager buyers pursued last-ditch efforts to secure a home purchase before the mortgage rate surge,” says Selma Hepp, deputy chief economist for CoreLogic.

The median existing single-family home price was $397,600 in April, up 14.8% from April 2021

But there are indications that the Federal Reserve rate increases to control inflation are beginning to influence the housing market, experts say. And they expect a deceleration in the growth rate of U.S. home prices and better market conditions for those looking to buy homes.

The median existing-home sales price increased at a slower year-over-year pace of 14.8% to $391,200 in April, according to the National Association of Realtors. It grew by 19% from April 2020 to April 2021.

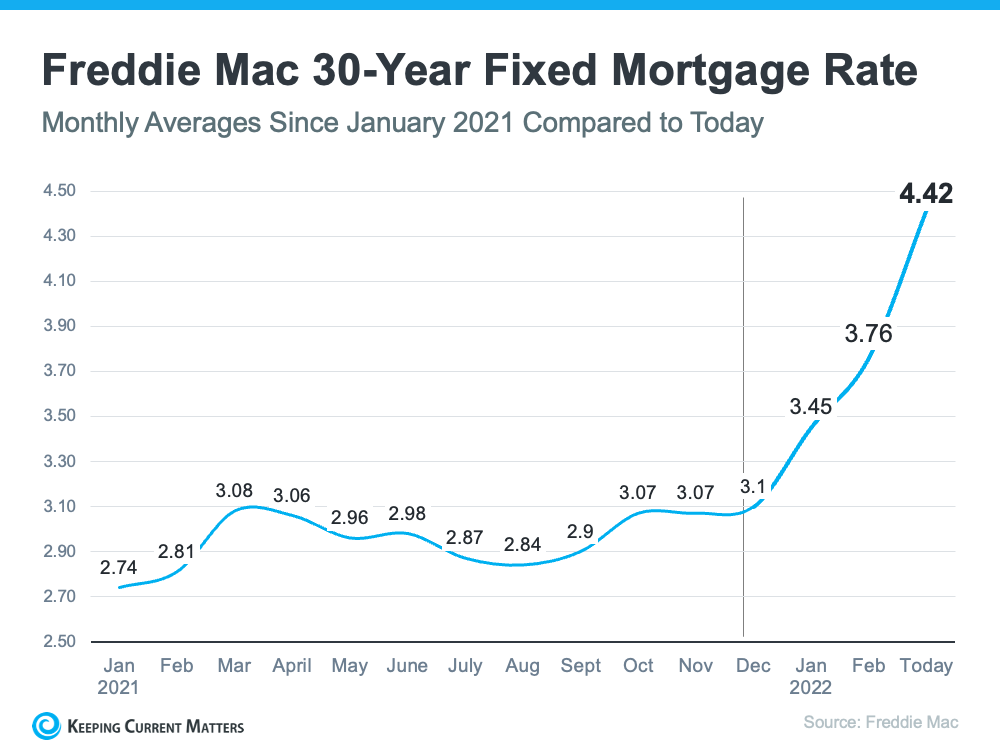

The Fed began raising interest rates in March to control inflation for the first time since slashing them to zero in March 2020. The 30-year fixed mortgage rate increased from 3.7% in the beginning of March to 5.1% for the week ending May 26.

Fed rate hikes

A month or two into the rate increases, the effects on the housing market were already showing. For instance, the share of listings with price drops reached a 21/2-year high in May, according to Redfin.

About 1 in 5 sellers, or 19% of listings, dropped their price in the four weeks ending on May 22, up from 13% a month earlier and 9.8% a year ago.

Touring activity from the first week of January through May 22 was 29 percentage points behind the same period last year.

“We’re seeing more and more buyers pull back, whether that’s a decline in people searching for homes, a decline in people touring homes, getting mortgage applications approved for buying a home – pretty much all of these leading indicators show a continuation of buyers reacting to the higher interest rates,” says Taylor Marr, deputy chief economist for Redfin.

In 2018, when the market began cooling as a result of higher interest rates and homes were taking longer to sell and prices had to drop to meet buyers’ budgets, new listings increased, Marr says.

“We saw more sellers rush to put their homes for sale,” he says.

Unlike 2018, however, fewer homes are hitting the market now.

“They’re on par with a year ago, but we’re not really seeing a growth of supply hit the market,” he says.

Lack of move-up buyers

One big reason is homeowners who have locked in low mortgage rates. About half (51%) of U.S. homeowners with mortgages have a mortgage rate under 4% – substantially below today’s 5%, according to a Redfin analysis of Federal Housing Finance Agency data from the fourth quarter of 2021. The report covers roughly 80 million owner-occupied U.S. households, of which about two-thirds (62%) have an outstanding mortgage.

“That disincentivizes move-up buyers who might decide they’re going to keep their current mortgage because the interest rate is so low,” Marr says.

The rate of increase in interest rates was also not as sudden or pronounced in 2018 as it is now (.5% vs .8%), Marr adds.

While house prices continued their climb in March, there are signs we are at or near an inflection point in the housing market, says PNC senior economist Abbey Omodunbi.

Housing starts decreased in March and April, and the number of existing-home sales, which account for about 90% of total home sales, declined during the same time period and is at the lowest level since June 2020.

Single-family home sales decreased to 4.99 million in April, down 2.5% from 5.12 million in March and down 4.8% from one year ago, according to the National Association of Realtors.

In May, homebuilder sentiment, measured by the National Association of Homebuilders, was at the lowest point since June 2020. As the Federal Reserve focuses on slowing demand and reducing inflation, long-term interest rates probably will continue to rise, which will contribute to slower house price growth over the next two years, Omodunbi says.

What does this all mean for those trying to enter the housing market?

A ‘balanced housing market’

The Fed’s actions to temper inflation appear to be normalizing the market and cooling demand, says Steve Reich, chief operating officer of Finance of America Mortgage.

For the week ending May 27, mortgage applications decreased 2.3% from one week earlier and 14% from the same week one year ago, according to the Mortgage Bankers Association.

“I believe price appreciation is likely to become more gradual over the summer and throughout the duration of the year,” he says. “Inventory has also been on the rise since reaching a low point this January, and this may help ease price appreciation further in some markets.”

That is good news for buyers, Marr says.

“The market’s kind of rebalancing toward a more balanced market where buyers have a little bit more power and sellers have a little bit less pricing power.”

Copyright 2022, USATODAY.com, USA TODAY

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

The price of residential real estate has skyrocketed in the past two years. No single reason accounts for this, but several have contributed.

The price of residential real estate has skyrocketed in the past two years. No single reason accounts for this, but several have contributed.

Home costs have risen by record amounts in the past two years. The carefully followed S&P CoreLogic Case-Shiller Indices showed that

Home costs have risen by record amounts in the past two years. The carefully followed S&P CoreLogic Case-Shiller Indices showed that

During a time when the cost of housing is at an all-time high, the city of Stuart has decided to deny a new housing development comprised of 77 new townhomes.

During a time when the cost of housing is at an all-time high, the city of Stuart has decided to deny a new housing development comprised of 77 new townhomes.

Comments / 1